You want to be able to analyze the money you’re spending on labor to determine your future decisions. Charts of Accounts often fall short because they include too much information. The “QuickBooks Default” also doesn’t take into account any industry-specific considerations that may impact the success factors of your COA. While this may fill a need for smaller teams with straightforward financial considerations, many startups quickly outgrow it. When your financial situation becomes more complicated—including hiring, investing in technology to help you grow, and bringing in VC funding—a need arises for a more complex solution.

Explanation: What Is a Chart of Accounts?

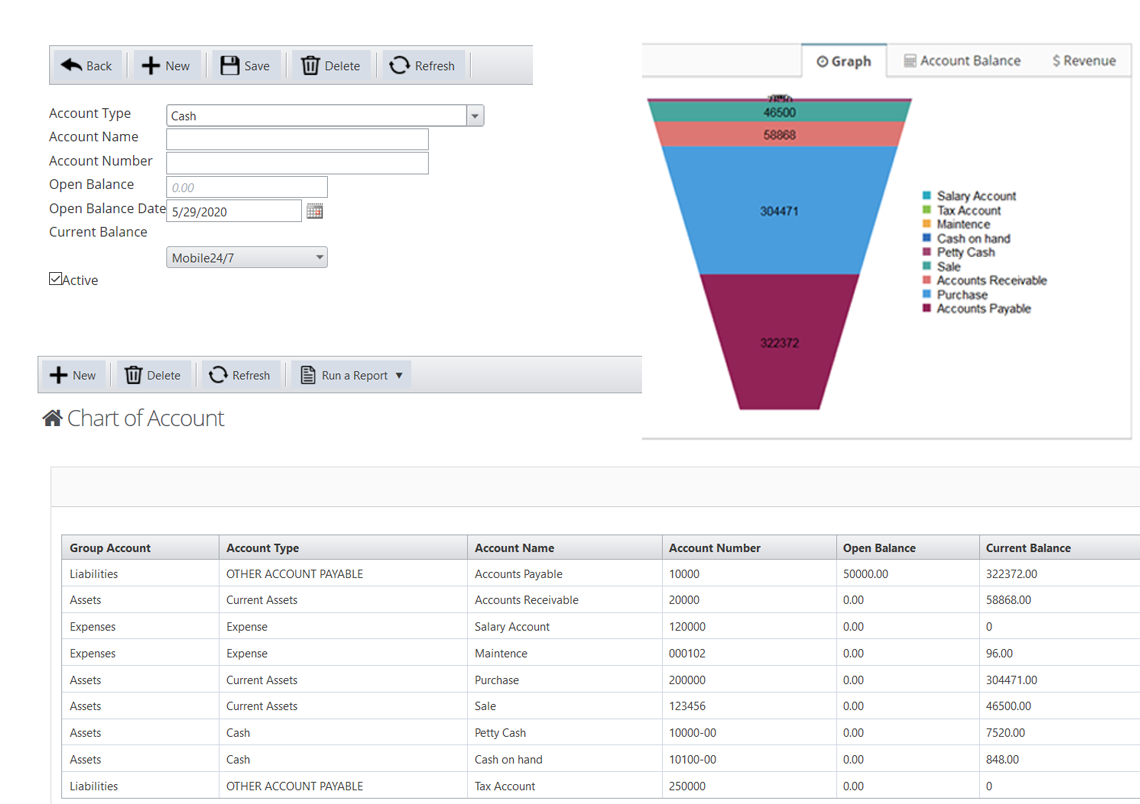

Although most accounting software packages like Quickbooks come with a standard or default list of accounts, bookkeepers can set up and customize their account structure to fit their business and industry. The purpose of the code is simply to group similar accounts together, and to provide an easy method of referring to an account when preparing journal entries. For example the inventory codes run from 400 to 499 so there is plenty of room to incorporate new categories of inventory if needed. A chart of accounts gives you great insight into your business’s revenue beyond just telling you how much money you earn. It shows peaks and valleys in your income, how much cash flow is at your disposal, and how long it should last you given your average monthly business expenses.

Looking To Get Started?

Well, most companies borrow a page from your local library and the Dewey decimal system, assigning account identifiers when booking entries rather than wordy, cumbersome, text-based descriptions. We recommend beginning this process with your balance sheet accounts and then adding your income statement and other necessary accounts. The expense accounts category captures all of the money you spend generating revenues for your company – advertising expenses, employee benefits, office supplies expenses, rent, utilities, and endless more. As a slight aside, it’s also important to keep in mind the relationship between your COA, GL, and financial statements.

Create sub-accounts

This would include Owner’s Equity or Shareholder’s Equity, depending on your business’s structure. The basic equation for determining equity is a company’s assets minus its liabilities. Since different types of entities use different types of accounts, there is no one single chart of accounts template that would be applicable to all businesses. Each account in the chart of accounts is usually assigned a unique code by which it can be easily identified.

Get the maximum refund that you deserve with a dedicated Tax Pro on your side. We can then better understand your needs and craft the right solution for your organization. But ultimately, how effective it is in informing your decision-makers and ensuring an efficient record-to-report process is up to you.

- The structure of the chart of accounts makes it easier to locate specific accounts, facilitates consistent posting of journal entries, and enables efficient management of financial information over time.

- You can customize your COA so that the structure reflects the specific needs of your business.

- In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children.

- A business transaction will fall into one of these categories, providing an easily understood breakdown of all financial transactions conducted during a specific accounting period.

- For example, all the cash accounts have numbers in the range 1000 to 1999.

What is the standard chart of accounts?

Similarly, the accounts listed within the chart of accounts will largely depend on the nature of the business. Even for a small business, however, more digits allow the flexibility to add new accounts as the business grows in the future, while maintaining the logical order of the coding system. Commonly, it comprises of numbers only, texts only or combination between numbers and texts. This Chart of Accounts template provides common numbers and names you can use as references. Let’s start with the number one expense (and asset – but not from an accounting sense) – PEOPLE. Every company is different so, depending on your operations, industry, and other critical factors, the template is only as good as you make it.

This column is for information only to indicate whether the account is normally increased by a debit or a credit. For example expense accounts are normally increased by a debit entry, whereas income accounts are normally increased by a credit entry. The account names will depend on your type of business, but the classification and grouping should be similar to the sample chart of accounts. Expense-tracking platforms and other relevant software can help you maintain accurate account balances more easily if they can be integrated into your accounting software.

Simply put, without an informative chart of accounts that’s customized to your particular needs, your decision-makers are leading your organization with blinders on. Well, that’s exactly how someone looking through your financials would feel if it wasn’t for the accounting equivalent of that life-saving index – the chart what’s the recovery rebate credit of accounts (COA). For a small business it is important not to over complicate the chart of accounts. A small business does not need many of the accounts required for a large corporation. QuickBooks Online automatically sets up a chart of accounts for you based on your business, with the option to customise it as needed.