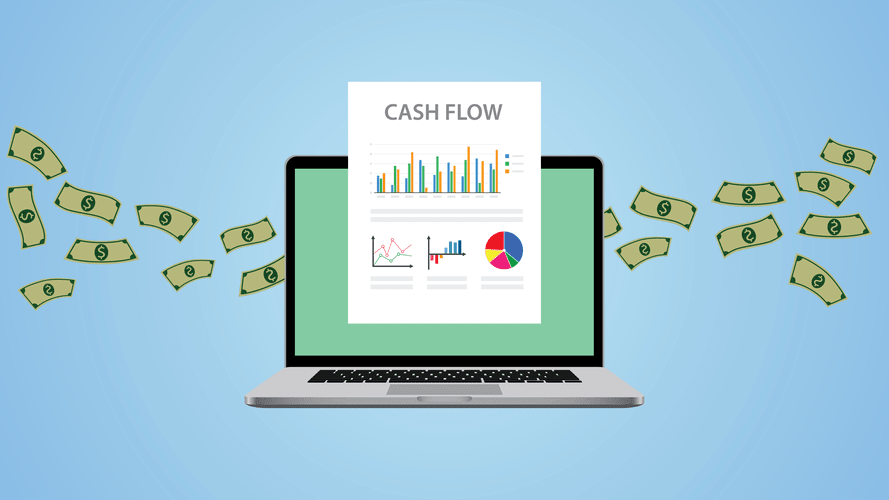

Income statements are also carefully reviewed when a business wants to cut spending or determine strategies for growth. This income statement shows that the company brought in a total of $4.358 billion through sales, and it cost approximately $2.738 billion to achieve those sales, for a gross profit of $1.619 billion. An income statement reveals a company’s financial performance over a specific period, narrating the story of the business’s operational activities. Precise financial records require proper categorization of expenses and revenues. Errors often arise from misclassifications and omissions of one-time gains. Utilize accounting software and a detailed checklist to ensure which accounts are found on an income statement accurate entries and comprehensive income tracking.

- Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined.

- Income statements are an essential part of a company’s financial reporting.

- You can earn our Income Statement Certificate of Achievement when you join PRO Plus.

- As a working professional, business owner, entrepreneur, or investor, knowing how to read and analyze data from an income statement—one of the most important financial documents companies produce—is a critical skill to have.

What are the three main tools of financial analysis?

This can also be referred to as earnings before interest and taxes (EBIT). It tracks the company’s revenue, expenses, gains, and losses during a set period. The accounting standards update represents the final formal step in the years-long project — known as the disaggregation of income statement expenses or DISE — by the U.S. accounting standard setter. The rules will be effective for annual reporting periods beginning after Dec. 15, 2026 and for interim or quarterly periods beginning after Dec. 15, 2027, the FASB press release states. For a manufacturer these are expenses outside of the manufacturing function. (However, interest expense and other nonoperating expenses are not included; they are reported separately.) These expenses are not considered to be product costs and are not allocated to items in inventory or to cost of goods sold.

Primary-Activity Expenses

Consider business XYZ that earned $25,000 from the sale of goods and $3,000 as revenue from training personnel. In return, the business spent money on various activities, including wages, rent, transportation, etc., leading to $14,200 in expenses. The business also gained $1,500 from the sale of an old van and incurred a $2,000 loss from a pending lawsuit. Operating income is the result of subtracting the company’s operating expenses from its operating revenues. Financial analysis of an income statement can reveal that the costs of goods sold are falling, or that sales have been improving, while return on equity is rising.

Benefits of a single-step income statement for small businesses

In response to the second weakness, accountants gather and report information about the effects of the various types of changes in owners’ equity throughout the year. Here’s an example of an https://x.com/bookstimeinc income statement from a fictional company for the year that ended on September 28, 2019. Automating data entry processes and conducting regular audits can help reduce manual data entry errors like duplication and omissions.

- On the other hand, there is no recognition of revenue if, despite the customer paying, no service is forthcoming.

- They use competitors’ P&L to gauge how well other companies are doing in their space and whether or not they should enter new markets and try to compete with other companies.

- The Revenue section shows that Microsoft’s gross margin, also known as gross (annual) profit, for the fiscal year ending June 30, 2023, was $171.0 billion.

- The accounts receivable turnover ratio is a simple formula to calculate how quickly your clients pay.

Operating Events

- The two sub-elements, gains and losses, represent the net increases and decreases in owners’ equity resulting from non-operating events, including sales of non-inventory assets, casualty losses, and other events.

- Net income is used for calculation in many ratios in order to evaluate the company’s performance, including net profit margin, return on assets, return on equity, and earnings per share (EPS).

- The multi-step income statement reflects comprehensively the three levels of profitability – gross profit, operating profit, and net profit.

- HBS Online does not use race, gender, ethnicity, or any protected class as criteria for enrollment for any HBS Online program.

- These deductions are subtracted from the revenue figure to derive a net revenue number.

EBIT is the resulting figure after all non-operating items, excluding interest and taxes, are factored into operating profit. The Internal Revenue Service (IRS) permits businesses to deduct operating expenses if the business operates to gain profits. Operating expenses are basically the selling, general, and administrative costs, depreciation, and amortization of assets. It is also referred to as the cost of sales if the company is offering services. This means that revenues and expenses are classified whether they are part of the primary operations of the business or not.

What Is the Difference Between Operating Revenue and Non-Operating Revenue?

It is the mathematical result of revenues and gains minus the cost of goods sold and all expenses and losses (including income tax expense if the company is a regular corporation) provided the result is a positive amount. It’s frequently used in absolute comparisons but can be used as percentages, too. An income statement is a financial report detailing a company’s income Online Accounting and expenses over a reporting period.

While this concept may help identify relevant measures of income, it fails to provide a model for accountants to apply to generate useful information. What are accountancy standards, and what are the issues at stake for accountancy professionals? From understanding the applicable rates, to choosing the right regime and reporting, we cover everything you need to navigate the world of VAT with confidence. We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan.

On the other hand, there is no recognition of revenue if, despite the customer paying, no service is forthcoming. This situation creates a liability that requires satisfaction either by service or a refund. In a qualitative sense, revenue can represent a reward obtained by providing goods or services to customers. This modification excludes corrections of errors made in measuring the operating events of previous years.

COGS only involves direct expenses like raw materials, labor and shipping costs. If you roast and sell coffee like Coffee Roaster Enterprises, this might include the cost of raw coffee beans, wages, and packaging. Income statements can be prepared monthly, quarterly, or annually, depending on your reporting needs.