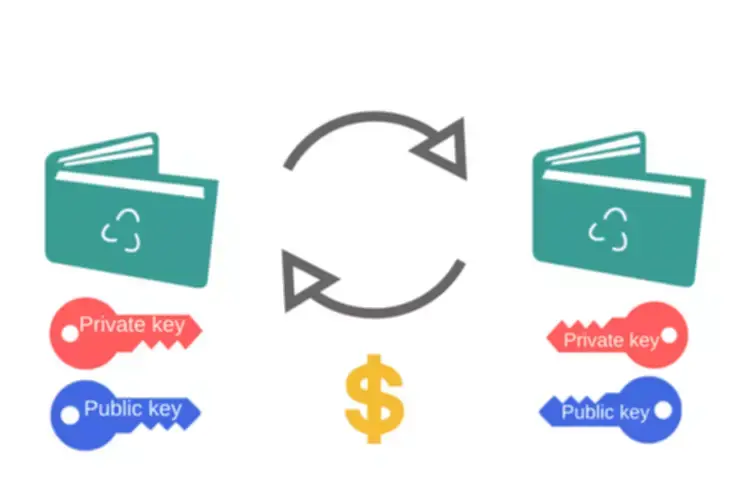

Upon expiration of the contract, the customer is obligated to obtain and buy the asset, while the vendor is obligated to deliver and promote the asset. Crypto derivatives function similarly to traditional derivatives, where a buyer and seller enter into a contract to sell an underlying asset, with the asset being sold at a predetermined time and worth. Derivatives can provide a way for traders to diversify their portfolios, maximizing returns and effectively managing the risks. Trading crypto derivatives on completely different belongings can provide a more balanced portfolio by lowering particular person market risks. Options contracts offer merchants a proper, not an obligation, to purchase or promote an underlying asset at a predetermined price before the contract’s expiration date. Derivatives buying and selling, particularly within the realm of cryptocurrencies, presents a world of opportunity for seasoned and novice traders alike.

DYOR, or “do your own research,” is essential to profitable trading in any market, including the crypto derivatives market. By conducting your personal research and analysis, you can better perceive the market, the belongings you’re trading, and the potential risks crypto derivatives meaning and rewards concerned. To clarify, this tool will mechanically promote a position if it reaches a sure value, limiting potential losses. Additionally, merchants typically diversify their portfolios across different assets to keep away from overexposure to anyone place or asset.

Dangers

The significance of crypto derivatives within the trendy financial landscape extends past mere buying and selling devices. These derivatives function vital instruments for market stabilization, danger management, and enhancing total market efficiency. But with their complicated nature and potential risks, it’s necessary to grasp the ins and outs of the crypto derivatives market earlier than diving in. Learn about the principle sorts, together with options and futures, and whether to trade them.

When getting into into a futures contract, merchants can take a protracted or brief position, indicating the course they consider the asset’s price will move. The first profit is that each one merchants can speculate on and profit from the underlying assets’ future value actions. As such, it could possibly allow you to leverage, hedge, diversify, and speculate on value actions.

The derivatives market is the place individuals commerce contracts as an alternative of the actual asset itself. Assume that you are bullish on Apple (AAPL) and owns a big amount of AAPL shares. You can use derivatives – in the type of choices contracts – to reduce your total investment danger. Using a type of choices referred to as ‘put options’, you possibly can profit from your options contract since they’ll improve in value when costs of the underlying asset (in this case AAPL stocks) goes down.

What Are Crypto Derivatives? Types, Features & Top Exchanges

In contrast, excessive liquidity attracts extra market individuals, facilitates environment friendly and clear market development, and reduces the chance of market manipulation. The function of this website is solely to display information relating to the products and services available on the Crypto.com App. To trade derivatives on the Crypto.com Exchange, users should not be in a geo-restricted jurisdiction. Here is a detailed step-by-step information on tips on how to allow derivatives on the Exchange. Discover the necessities of the Markets in Crypto-Assets (MiCA) regulation, the EU’s new framework for regulating crypto businesses.

It’s a complex yet probably lucrative area, demanding cautious technique and an understanding of the unstable nature of the cryptocurrency market. Let’s delve into the particular advantages and downsides to supply a clearer image of what traders can count on from this multifaceted buying and selling technique. A long position is when a dealer believes that the underlying asset’s price (e.g., Bitcoin) will improve sooner or later. A quick place, on the other hand, is when a dealer believes that the underlying asset’s value will lower sooner or later. With the rise of cryptocurrencies, derivatives have emerged as a preferred tool for traders to manage risk and speculate on the price movements of digital belongings. A derivative is a contract or product whose value is set by an underlying asset.

What Is Derivative Buying And Selling In Crypto?

As a result, it is important to examine that particular country’s laws and rules, meaning that the contract must also be throughout the identical geographical space. Swaps are crypto derivatives that allow the concerned parties to trade their cash flows from two completely different financial property. Crypto derivatives buying and selling, while offering significant alternatives, comes with notable challenges. The complexity of those instruments requires a deep understanding of market dynamics and the specifics of each derivative sort, posing a steep studying curve. Derivatives also allow traders to hedge their risks and manage their portfolios more effectively, growing market effectivity.

Throughout his career, Cem served as a tech marketing consultant, tech buyer and tech entrepreneur. He suggested businesses on their enterprise software program, automation, cloud, AI / ML and different know-how related decisions at McKinsey & Company and Altman Solon for more than a decade. He has also led industrial development of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem’s work in Hypatos was lined by main technology publications like TechCrunch and Business Insider. He graduated from Bogazici University as a pc engineer and holds an MBA from Columbia Business School.

The easiest method to ‘short’ is so that you can borrow a safety from a 3rd celebration (an change or broker) and sell it instantly in the market since you expect costs to fall. You can re-enter the market as quickly as costs have fallen and purchase again the same amount of securities that you initially bought. In this case, you’ll revenue from promoting the securities initially and buying them back at lower prices. Derivatives are useful for threat management, providing hedging alternatives against market fluctuations, particularly for these holding massive positions. This strategy not solely protects investments but also opens avenues for revenue throughout market downturns. Trading derivatives can be extremely complicated, and there’s no one-size-fits-all approach to success.

The Place To Commerce Crypto Derivatives?

Let’s take a deeper dive and analyze a few of the most useful aspects that crypto derivatives deliver to the crypto market. An ETF is a contract that tracks the price evolution of a specific crypto or group of cryptos. Traders can diversify their portfolios with ETFs without having to purchase and personal the property they monitor. ETFs aren’t crypto derivatives; nevertheless, a multifaceted relationship is determined by the specific kind of ETF. Therefore, this by-product contract has 4 options, and the contract’s proprietor can be on the long aspect or the brief aspect of either the put or name possibility, as seen within the picture under.

A call choice offers the holder the best to purchase crypto at a predetermined value, whereas a put possibility offers the holder the best to sell at a predetermined value. As of March 2024, Crypto.com has started offering crypto derivatives in app for customers in regions https://www.xcritical.com/ where it is allowed. We have previously written about spot exchanges in crypto, DeFi exchanges in crypto and at present we are going to cowl spinoff exchanges. Please make certain that you’ve learn our disclaimer on investment-related topics earlier than proceeding.

Furthermore, limiting traders’ losses allows them to make more rational trading choices. They are also leveraged devices as a end result of the amount paid to hold the choice is small relative to the whole contract value. A conventional change that at present offers Bitcoin futures is the CME Group, as CBOE has yet to add new contracts since March 2019. However, in June 2023, CBOE received the CFTC’s (Commodity Futures Trading Commission) approval to launch margined futures contracts for Bitcoin and Ethereum. Let’s take the present price of Bitcoin, which is $42,934.sixty eight – a trader may either buy or sell the Bitcoin futures contract in anticipation of either a price decline or an increase. Depending in your stance on the price of Bitcoin, the trade platform will match the dealer with someone who went the wrong way when it comes to betting.

Cryptocurrency Stats: History, Market, Adoption, Users& Crimes

Liquidity is a important component of the crypto sector, very like any monetary market. In both cases, the trader pays a premium to buy the option, representing the choice contract’s worth. However, if Bitcoin’s price doesn’t follow the trader’s prediction, they can allow the option to run out, solely losing the paid premium. For example, the worth of a Bitcoin derivative is decided by the worth of Bitcoin.

Before we transfer on, let’s try to perceive the universe of cryptocurrency derivatives. If you’re totally knowledgeable and ready to go, interacting with the DeFi scene is straightforward with the Ledger ecosystem. Ledger Live offers several crypto buying and selling apps which let you buy, promote, lend and borrow in one single place. Then, this highly effective app works collectively along with your trusty Ledger system, permitting you to interact with the DeFi ecosystem, whereas staying protected from online threats. Other tactics include utilizing technical evaluation to determine developments and worth patterns and utilizing leverage to amplify potential profits. Please observe that the availability of the services on the Crypto.com App is subject to jurisdictional limitations.

At its core, hedging is a risk management strategy that takes the alternative stances to balance potential pitfalls. As such, you enter a particular position but perform in the opposite direction, hedging potential losses. As everyone knows, the crypto markets are notoriously risky, and derivatives magnify this volatility. As a end result, buying and selling derivatives require more advanced strategies and contracts, thus making them unsuitable for newbies. Perpetual futures or contracts are futures contracts that work without an expiry date, allowing fixed trading and value hypothesis.

- As of March 2024, Crypto.com has began offering crypto derivatives in app for customers in regions where it’s allowed.

- A call possibility offers the holder the proper to purchase crypto at a predetermined value, while a put choice offers the holder the best to sell at a predetermined value.

- Leveraging trading derivatives is one other important workflow that allows you to control extra with less, amplifying profits and losses.

- Swaps are crypto derivatives that enable the concerned parties to trade their cash flows from two different financial assets.

- Using a type of options referred to as ‘put options’, you possibly can profit from your choices contract since they’ll improve in worth when costs of the underlying asset (in this case AAPL stocks) goes down.

- For the needs of crypto, liquidity most frequently refers to financial liquidity and market liquidity.

However, there’s a distinction compared to conventional futures contracts, which cater to ongoing buying and selling, thus adaptability. As we know, crypto derivatives are complex financial devices which have become highly well-liked within the crypto landscape. You could think of derivatives trading as an integral part of the crypto financial system since it is part of a mature financial system.