Many investors look for a company to have a debt ratio between 0.3 (30%) and 0.6 (60%). A debt ratio of 0.6 (60%) or higher makes it more difficult to borrow money. Lenders often have debt ratio limits and won’t extend further credit to firms that are overleveraged. Of course, there are other factors as well, such closing balance in accounting accounting dictionary as creditworthiness, payment history, and professional relationships. On the other hand, the typically steady preferred dividend, par value, and liquidation rights make preferred shares look more like debt. Gearing ratios constitute a broad category of financial ratios, of which the D/E ratio is the best known.

Use of the Debt Ratio Formula

This ratio is not just a number; it’s a tool for strategic planning for both large and small companies. It helps assess financial risk, guide investment decisions, and ensure long-term sustainability. The ratio represents its ability to hold the debt and be in a position to repay the debt, if necessary, on an urgent basis.

- There is no one figure that characterizes a “good” debt ratio, as different companies will require different amounts of debt based on the industry in which they operate.

- Tesla had total liabilities of $30,548,000 and total shareholders’ equity of $30,189,000.

- For example, the United States Department of Agriculture keeps a close eye on how the relationship between farmland assets, debt, and equity change over time.

- A debt ratio of 0.6 (60%) or higher makes it more difficult to borrow money.

Essential Guide to Cleaning RV Filters for Better Performance and Comfort

On the other hand, investors rarely want to purchase the stock of a company with extremely low debt ratios. This is because a 0% ratio means that the firm never borrows to finance increased operations, which limits the total return that can be realized and passed on to shareholders. In terms of risk, ratios of 0.4 (40%) or lower are considered better ones. As the interest on a debt must be paid regardless of business profitability, too much debt may compromise the entire operation if cash flow dries up. Companies unable to service their own debt may be forced to sell off assets or declare bankruptcy.

Specific to Industries

This conservative financial stance might suggest that the company possesses a strong financial foundation, has lower financial risk, and might be more resilient during economic downturns. Perhaps 53.6% isn’t so bad after all when you consider that the industry average was about 75%. The result is that Starbucks has an easy time borrowing money—creditors trust that it is in a solid financial position and can be expected to pay them back in full. I’ve seen many potential RV owners overlook this vital aspect, often leading to financial strain down the line.

Transform Your RV: Top RV Interior Color Schemes for a Cozy, Inviting Space

The debt ratio is shown in decimal format because it calculates total liabilities as a percentage of total assets. As with many solvency ratios, a lower ratios is more favorable than a higher ratio. As businesses mature and generate steady cash flows, they might reduce their reliance on borrowed funds, thereby decreasing their debt ratios. The higher the debt ratio, the more leveraged a company is, implying greater financial risk. At the same time, leverage is an important tool that companies use to grow, and many businesses find sustainable uses for debt. Some sources consider the debt ratio to be total liabilities divided by total assets.

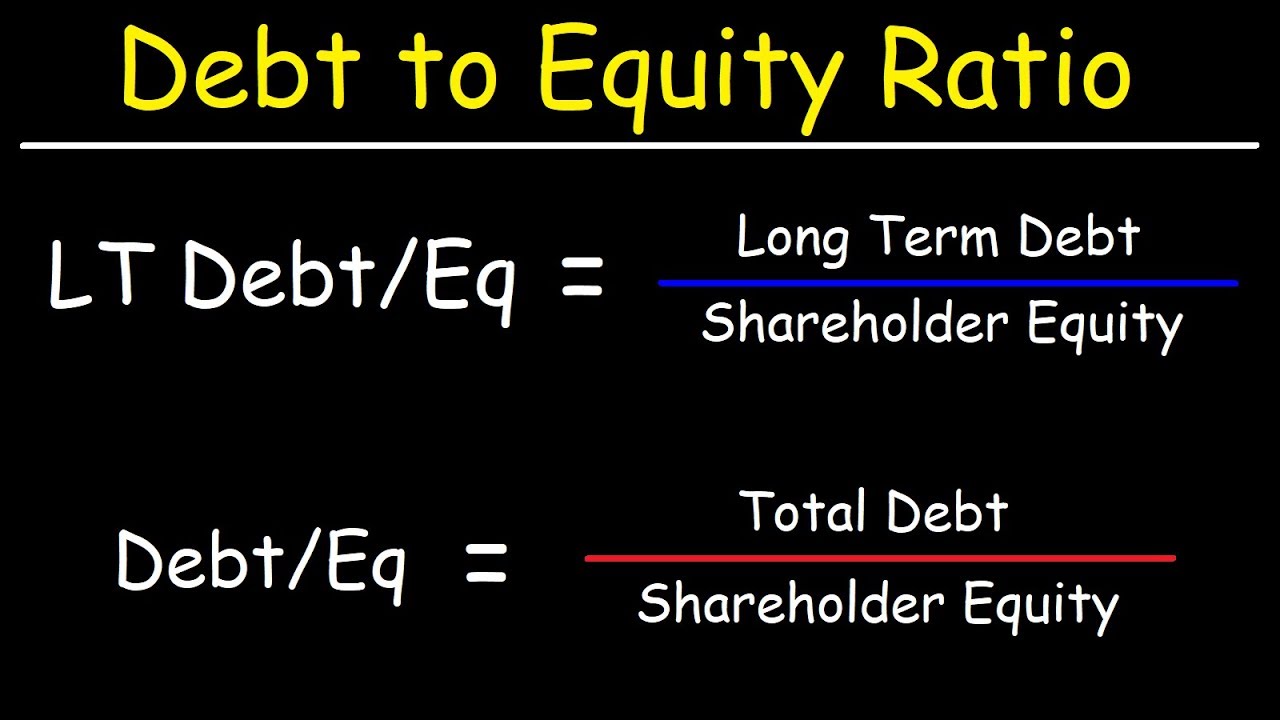

Different industries vary in D/E ratios because some industries may have intensive capital compared to others. Managers can use the D/E ratio to monitor a company’s capital structure and make sure it is in line with the optimal mix. On the other hand, when a company sells equity, it gives up a portion of its ownership stake in the business. The investor will then participate in the company’s profits (or losses) and will expect to receive a return on their investment for as long as they hold the stock. Let’s walk through an example of calculating debt ratio using data from Alphabet’s latest annual filing.

The debt-to-equity ratio is most useful when used to compare direct competitors. If a company’s D/E ratio significantly exceeds those of others in its industry, then its stock could be more risky. If both companies have $1.5 million in shareholder equity, then they both have a D/E ratio of 1.

When using the D/E ratio, it is very important to consider the industry in which the company operates. Because different industries have different capital needs and growth rates, a D/E ratio value that’s common in one industry might be a red flag in another. Gearing ratios focus more heavily on the concept of leverage than other ratios used in accounting or investment analysis.

The debt ratio holds a vital place in financial analysis as it can depict the financial stability of a company. It can serve as a reliable indication of how much a company relies on its debt for functioning and expansion. Banks and other credit providers will examine your own debt ratio (debt to asset/income) to determine if–and how much–they are willing to lend you for your business, home or other personal needs. For instance, capital-intensive companies with stable cash flows operate successfully with a much higher debt ratios. A high D/E ratio suggests that the company is sourcing more of its business operations by borrowing money, which may subject the company to potential risks if debt levels are too high.